Analysing March 2023 Precious Metals Performance and Q1 Price Trends: A Comprehensive Look at the Markets

Highlights:

- Precious metal performance was strongly influenced by changing economic conditions in mid-late March.

- In February, gold remained stable, silver fell, and platinum increased.

- AUD/USD settled in February after surging in January, currently down from April 2022 peak but up from October 2022 low.

- Gold prices surged in March after the collapse of three major US banks, reaching their highest levels in almost a year.

- Factors influencing precious metal value include the European Central Bank raising rates, the US Federal Reserve Bank announcing its ninth consecutive rate rise, and reports of up to 200 banks at risk of collapsing in the US.

- Safe haven buying occurred as investors turned to precious metals as a way to avoid potential banking industry fallout and act as a long-term inflation hedge against rising interest rates and inflation.

- and more...

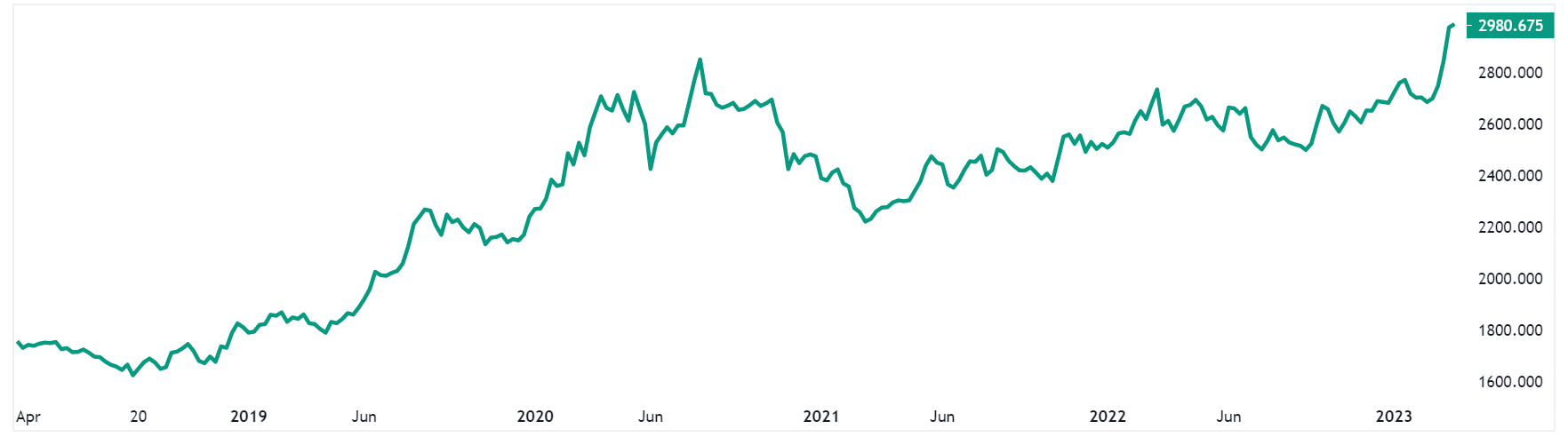

Changing economic conditions strongly influenced precious metal performance in mid-late March, which has resulted in price movements going against initial Q1 performance and countering predictions made by many analysts at the start of the year.

Source: Trading View

Looking Back to February 2023 Precious Metals Prices

Spot gold stable in February: Gold started the month at $2732.50 AUD per ounce, fell to $2654.46 AUD by Feb 14th, then ended the month at $2714.64 AUD.

Silver settles: Silver opened at $33.56 AUD per ounce in February before finishing the month at $31.02 AUD.

Platinum up: Platinum started the month at $1467.39 AUD per ounce before dropping to $1431.91 AUD at the end of February.

AUD to USD Currency Chart

Source: OFX

The AUD/USD settled in February after surging to 0.71 at the end of January. It is currently down from the April 2022 peak of 0.758 but up from last October’s low of 0.61.

Our previous technical market analysis contains a comprehensive review ofJanuary 2023 performance of precious metals, as well as a detailed assessment of the price performance in 2022, along with the 2023 market analysts' predictions.

Where Are We At Now - Rapid Movement: Gold Surges

The beginning of March saw precious metal experts stating that prices have been “weaker than some people have expected”. However, the collapse of three major banks in the US (Silicon Valley Bank, Signature Bank, and Silvergate) saw prices jump dramatically, reaching close to $3000 AUD per ounce and their highest levels in almost a year.

Analysts described the “best week in three years” by mid-March, as the value of gold rose from $1,867 USD an ounce to above $1,980 USD an ounce.

Meanwhile, silver reached a low of $30.46 AUD an ounce during early March, before rapidly recovering to $33.54 AUD following the month’s big economic news. Platinum has also continued its positive trajectory, climbing from $1453.35 an ounce at the start of the month to $1526.16 on March 14th.

Current Market Analysis

Gold prices rose in December and January, before falling slightly in February but surging in March as a result of the sudden collapse of three US-based banks.

Other factors influencing the change in precious metal value include:

- The European Central Bank raising rates by 50 basis points, bringing rates to their highest point in 14 years, in an attempt to bring inflation back to 2 per cent.

- The US Federal Reserve Bank announcing its ninth consecutive rate rise, taking rates to the highest level since 2007.

- International reports pointing to up to 200 banks being at risk of collapsing in the US.

- Investors and companies taking action to move money out of at-risk financial institutions, causing a potential liquidity crunch.

- News of multinational investment bank UBS taking over Switzerland’s second largest bank, Credit Suisse, after it also suffered serious liquidity issues.

- Share markets including the ASX experiencing accelerated losses.

These combined conditions have led to what’s known as a ‘safe haven’ buying event, with investors turning to precious metals as a way to avoid potential banking industry fallout and to act as a long-term inflation hedge against rising interest rates and inflation.

To quote one report, “The U.S. banking system is a complete mess and nobody knows how bad it will get,”. Because of this, commentators say, “it's only logical for gold to go up as markets are gripped with uncertainty.”

CPM Group’s Jeffrey Christian countered this somewhat in a recent video update, saying SVB was an “idiosyncratic bank in a tenuous industry”, warning that the collapse probably doesn’t spell problems for the broader economy, and adding that it probably represents a short term blip, although it is a sign of things to come and an indicator of fragility.

Mr Christian’s take in a video update was that gold “prices will further decompress over the next few days, as the markets realise that SVB is a quote, idiosyncratic situation, and it does not scale.”

With a long term view, however, Mr Christian said precious metal “prices will move higher when economic, financial and political factors grow much more serious. That could start to emerge in the fourth quarter of 2023 or 2024.”

In Australia, Reserve Bank Assistant Governor Chris Kent reassured the public in a speech that while volatility in Australian financial markets has picked up, Australian banks are “unquestionably strong” with solid capital buffers.

February 2023 Perth Mint Sales Performance

Back at home, the Perth Mint reported sales of 52,241 oz of gold and 1,484,936 oz of silver in minted product form during February.

The General Manager of Minted Products, Neil Vance said that sales of Australian gold bullion products slowed in February. “While still buoyant in historical terms, the result to some extent reflected the fact that we did not unveil any new gold investor coins during the month,” he said.

Meanwhile, silver sales bounced higher, with available press time fully utilised over the course of the period. As a result, the Mint shipped everything it produced in February.

Total gold holdings in The Perth Mint Depository increased by 0.80%, while silver holdings were down 0.29% in February. Compared to 12 months ago, gold holdings were down 5.35%, while silver holdings were down by 0.94%.

Perth Mint’s updates have also pointed to gold prices surging beyond $2,000 USD per ounce in 2023, however recent evolution in financial markets have some international experts now saying this could rise above $3,000 USD.

Gold prices have now reached their highest point since August 2020, which is excellent news for investors.

Source: Trading View

China’s Gold Deposit Discovery

Finally, it was reported recently that China has recently discovered a huge gold deposit in one of the country’s largest gold producing areas, with a reserve of nearly 50 tonnes.

The deposit contains high-quality gold ore, which can be easily mined and refined, and can be sold for around $3 billion at the current market price.

Diversify to Secure Your Investment Portfolio

Market and economic fluctuations and uncertainty, nerves around banking industry performance and expert predictions about the rising value of gold and silver have highlighted the value of precious metals as a safe investment.

To discuss investment opportunities in 2023, reach out to one of our knowledgeable and supportive precious metals advisors - send us an email at info@jaggards.com.au or give us a call at 02 9230 0886.

Disclaimer

Please note that past performance does not guarantee future results. This news and any links provided are for general information only and should not be taken as constituting professional advice from Jaggards.

Jaggards is not a financial adviser. We recommend you seek independent financial advice before making any financial decisions based on the information contained in this article.