Australian Inflation Eases Ahead of Schedule but Challenges Remain

Across the Pacific, attention is shifting to the financial position of the United States government, where the Treasury is once again edging dangerously close to its debt ceiling. Without action from Congress to raise or suspend the limit, the Treasury could run out of cash by mid-year. While the debt ceiling saga is a familiar one in U.S. politics, the closer it gets to default, the more nervous global markets tend to become. Bond markets will be watching closely over the coming months.

Adding to the gloom, a well-respected valuation indicator has just posted its most bearish reading in U.S. history. The metric, known as the "Single Greatest Predictor of Future Stock Market Returns," tracks the average U.S. investor's allocation to equities. Historically, high allocation levels correlate with lower long-term returns. Its current signal suggests the S&P 500 could return minus 4.2% per year on an inflation-adjusted basis over the next decade. If history is any guide, now may not be the time to chase the bull.

Market Indicators to Watch

- Australia CPI (Monthly) – Due Wednesday, 27 March 2025, at 11:30 am AEST

- U.S. Core PCE Price Index – Due Friday, 29 March 2025, at 11:30 pm AEST

- China Manufacturing PMI – Due Sunday, 31 March 2025, at 12:00 pm AEST

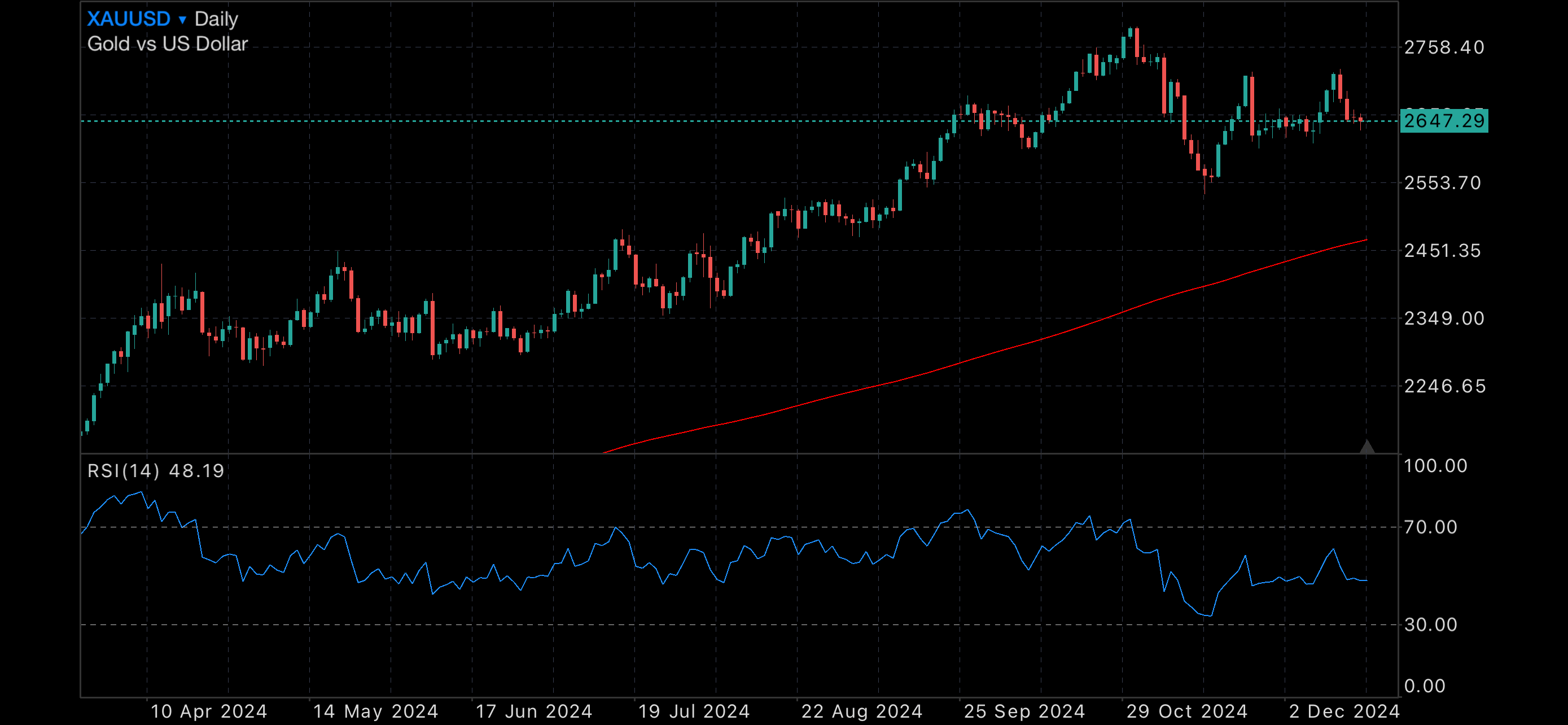

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA