Australian jobs at dangerous pivot point

Following Australia’s job market data for January, local economists are now taking deep breaths and getting ready for the ‘less enjoyable’ part of monetary tightening.

As CPI and inflation seems to progressively coming more and more under control, one of the biggest consequences of monetary tightening is unemployment. Unemployment hit 4.1% last month, and underemployment hit 6.6%. For those new to the term underemployment, this is a new measurement term meant to capture people who are only working minimal hours and are looking for more work. This measurement term came about from the Gig economy where many are now working multiple jobs to meet their needs.

January added only 500 jobs to the market, compared to 62,800 jobs added to the economy in December.

With the RBA predicting unemployment to peak at 4.3%, it’s looking like jobs are slipping away faster than expected. This won’t reverse until monetary policy is eased and even then won’t turn around immediately, with many predicting 12 months of downward pressure on the jobs market - making 2024 a rough year for many. Regardless if the RBA reduces rates, it is hard to pay for a mortgage at any interest rate when you’re under/unemployed.

In a comment on how quickly the economy can move from ‘under control and soft landing’ to ‘broken’, we’d reference a lovely quote from Ernest Hemingway in The Sun Also Rises. “How did you go bankrupt?”, “Slowly, then quickly”.

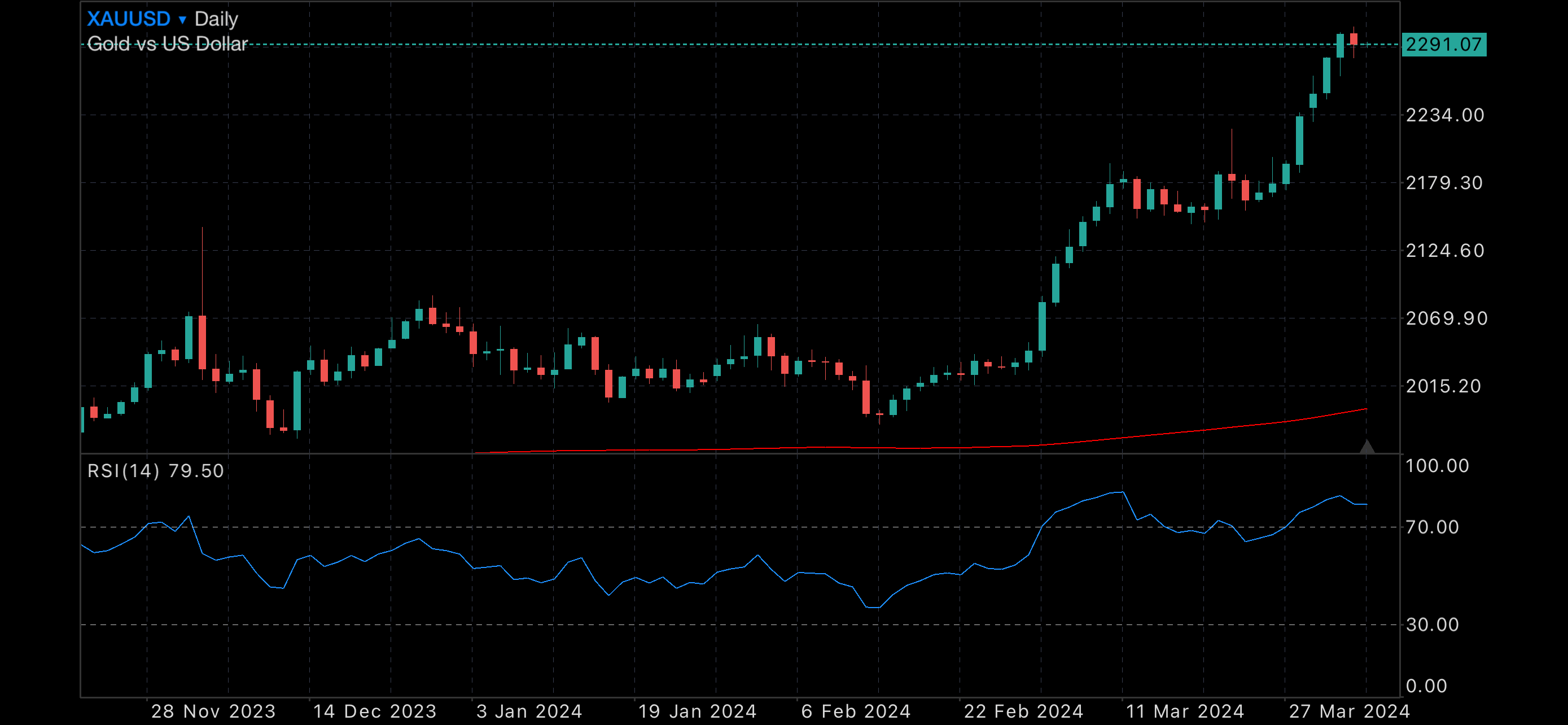

Where we saw Gold drop alongside all stocks earlier this week, as predicted it has rebounded strongly - up from $1984 to $US2004 at the time of writing.

Enjoy today’s charts and forecast below.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures Monthly analysis continues to recommend a STRONG BUY with Weekly analysis a NEUTRAL signal.

Technical indicators - Monthly Projections

RSI(14) | Buy |

STOCH(9,6) | Buy |

STOCHRSI(14) | Neutral |

MACD(12,26) | Buy |

ADX(14) | Buy |

Williams %R | Buy |

CCI(14) | Buy |

ATR(14) | Less Volatility |

Highs/Lows(14) | Neutral |

Ultimate Oscillator | Buy |

ROC | Buy |

Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

*Not financial advice, please DYOR prior to any investment decisions you make.