The Beginner's Investing Guide: Part 3 - When is the best time to buy gold?

Our recent series addresses the most common questions about purchasing gold and other precious metals.

If you missed parts one and two, click the links below:

Part One: Why invest in precious metals?

Part Two: How much precious metal should you buy?

This installment explores the best time to buy gold and silver bullion.

When is the best time to buy gold or silver bullion?

As with most good investments, the best time to make a purchase is in the past. The second-best time is now. However, if you want to get better returns, faster, you may apply a more specific strategy.

Here are the factors to consider when it comes to timing your precious metal investment:

Economic conditions

Different types of investments perform differently during changing economic cycles. For example, low interest rates are likely to push property prices up. During a recession, property values may drop, which means it is a good time to make a purchase if you can cover the holding costs and hold onto the property until the market rises again.

As explained on CBS news, buying gold is a strategy to hedge against inflation and side-step the risks that come with a major stock market drop. If economic uncertainty is on the horizon, experts and financial planners may point their clients towards a tangible precious investment as the price of gold tends to hold strong or even increase.

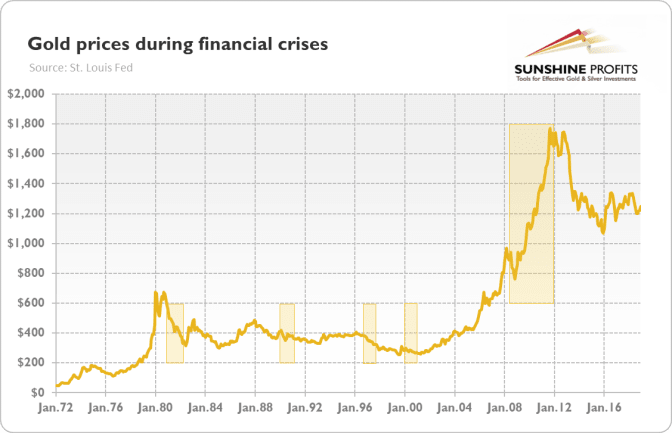

In 2023, with economic uncertainty on people’s minds, it’s likely that the value of precious metals will rise. Take a look at the table below, from Sunshine Profits in the USA. It shows that during times of financial crisis, gold prices have dipped then surged. It’s also worth noting how a peak does tend to correct itself quite quickly. This may influence your buying/selling decisions.

Image Source: Sunshine Profits

Political climates

World events impact the value of precious metals and may influence your decisions around when to buy gold.

Gold is often described as a ‘safe haven’. This is because events such as elections, wars and natural disasters can influence currency value and share prices. Gold sits on a level outside of these and can be seen as a steadier investment. If you have a significant portion of your portfolio in shares and there is global volatility, you can potentially introduce more stability by buying gold.

As explained in Finance Monthly, “When political uncertainty comes around, the price of gold shoots up. More and more people will invest in gold as an immediate reaction to political turmoil, leading to increased demand and, of course, increased price.” If you already have gold in your portfolio, you stand to benefit financially from periods of political unrest.

It is not always possible to time a purchase directly with a period of political turmoil or a natural disaster but being aware of trends can help influence your decisions and strategy.

Supply & demand

The challenge with timing your gold purchase is other people doing the same.

For example, at the start of 2023, with many threats of a recession looming, the price of gold is rising As reported by mining.com, “Spot prices of the precious metal have shot above $1,900 an ounce, surging by about 18% since early November as inflationary pressures recede and markets anticipate less aggressive monetary policy from the US Federal Reserve.”

Because the price of gold does not differ across borders, a recession in some major markets can influence the price of gold in others.

Meanwhile, other precious metals such as silver and copper are also on the rise. As shared by Forbes, it’s forecast that insufficient supplies could drive the silver price per ounce to a nine-year high because of growing demand.

The other things to keep an eye on is mine production, scrap recycling and how precious metals are being used across industries. If there is a surge in demand, prices will rise. This is good news if you already have gold but make sure you get some advice if you are planning to make a purchase.

Historical evidence and monthly performance

Generally speaking, trends show gold and silver prices surge at the start of the year, slow mid year and pick up again in October, November and December. Therefore, if you want to buy, you should do so around autumn and winter. Then you can rely on trends to plan a sale in the later months.

With this being said, you’ll also need to compare year on year prices to double check you will sell for a profit. Work with your investment advisor to plan your sale based on monthly trends but keep economic conditions in mind as well.

Your investment strategy

Your decisions around the best time to buy gold and/or silver also depend on your strategy. For example, are you pushing for short-term returns or looking to create a stable, long-term portfolio?

You will need to take into account your:

- Long term plans

- Personal financial goals

- Ability to cover holding costs

- Planned investment/how much you want to spend

When you factor in your personal goals as well as market conditions, you’ll be able to decide if now is a good time to purchase gold and other precious metals.

The best time to buy gold

As you can see, it’s important to consider a range of factors such as the present and future economic conditions, recent and historic trends, current supply, your budget and global political conditions when you invest in precious metals.

However, there is one more saying: “It’s better to buy gold and wait, than wait to buy gold.”

Gold has historically risen in price throughout history. It’s difficult to go wrong, especially if your purchase is part of a balanced investment portfolio.

Looking to purchase precious metals? Connect with us now

Rest assured that you are in good hands. The Jaggards team has been assisting clients in safeguarding their wealth and retirement portfolios through precious metals for over 60 years. Take the first step towards securing your financial future by contacting us today. Speak with our knowledgeable professionals via phone - 02 9230 0886 or email us at info@jaggards.com.au

DISCLAIMER

Please note that past performance does not guarantee future results. This article and the links provided are for general information only and should not be taken as constituting professional advice from Jaggards.

Jaggards is not a financial adviser. We recommend you seek independent financial advice before making any financial decisions based on the information contained in this article.