CPI data inbound and Silver starts to Pop

10 April, 2024

As at 9am, AEST

Gold Spot Price $AU3553

Silver Spot Price $AU42.61

Platinum Spot Price $AU1494

Later today, the US FED will release its CPI data and we’re again guessing that they will reinforce their message that "Inflation is now under control, though we need to be cautious in lowering rates to ensure we don’t undo the work of the last year".

We’d still argue that the FED won’t start reducing rates until something clearly breaks within the economy. With employment still high, Wall Street results high and consumer credit/confidence doing reasonably well - it may be either the end of the year or even next year before we see any measurable change to monetary policy.

Interesting news from Australia regarding housing prices. With younger demographics already priced out of the market, economists are now predicting more housing market gains - in some cities up to 30% over the next 3 years. This information comes to light in the face of yet more inbound migrant pressure for housing amongst Australia’s already lower than required housing stock. With nowhere to buy, pricing simply goes up.

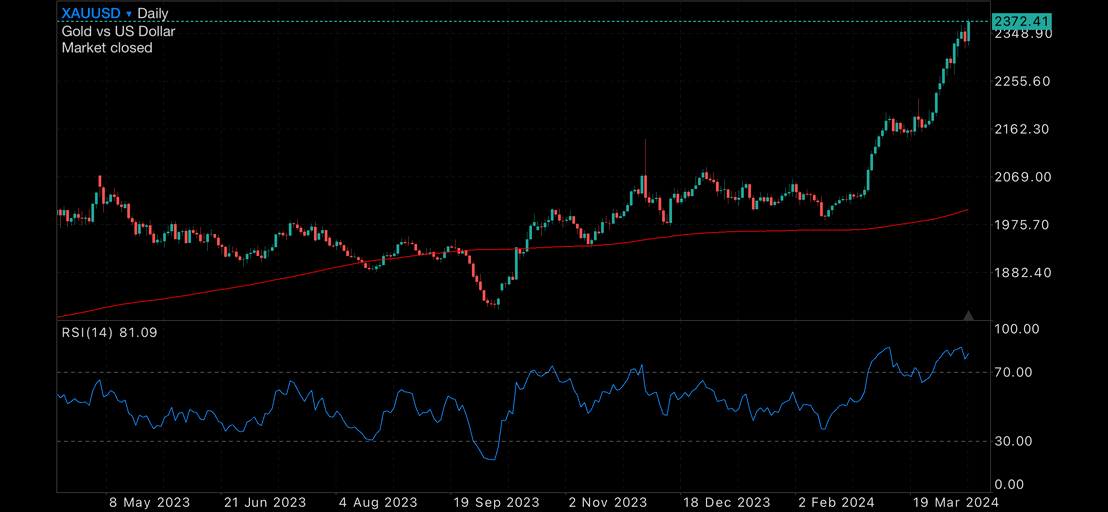

And Silver looks to have started its run. Finally matching Gold’s upward movement, Silver notoriously starts late but ends strong. All eyes are now watching these charts to see where Silver will end up. Already over AUD$40, some are predicting between AUD$60-70 for this bull cycle.

Enjoy today’s charts.

Gold daily, with 200MDA

Silver daily, with 200MDA

US500, with 200MDA

ASX200, with 200MDA