CPI slightly lower, Powell tight lipped with no rate cut

CPI results on Wednesday delivered exactly what the FED was looking for; ‘increased narrative around inflation slowly coming under control.’

Printing 3.4% (previously 3.5%) in latest data gives the FED a little room to breathe and figure out what comes next. And while CPI data keeps an even keel for the markets, we similarly saw a very tight lipped FED Chair Jerome Powell not really giving much away at all. In his address he reported no rate cut presently, but stated that the FED is ready to cut rates if inflation falls quickly. This isn’t rocket science and with major economies worldwide hanging on the FEDs every word and looking for some kind of guidance, we’re yet to receive any real clear communication about fiscal policy moving forward. While frustrating for many economists, this approach is very understandable.

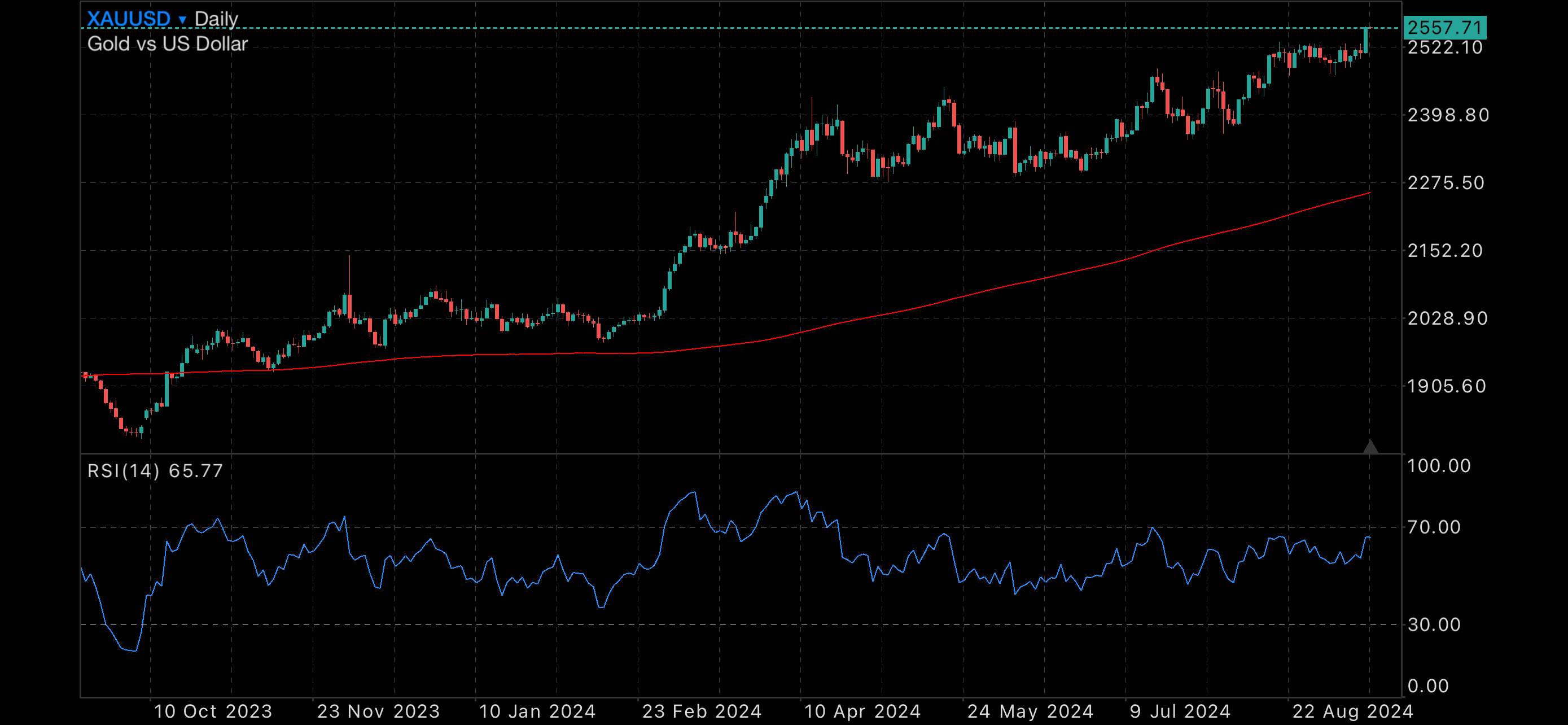

Gold has moved up and down this week, mostly on anticipated CPI data. Early on Gold surged upwards, only to pull back to its original position within the last day. Continued turmoil through Ukraine and Gaza are keeping prices strong, alongside a slightly higher oil price (which we will talk more to next week). Both precious metals are still well above their 200MDA but are both looking for new consolidation levels. The next few weeks will be telling to see if bullion will need to test their 200MDA’s or if they will find strength somewhere in-between.

Enjoy today’s forecasts.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures monthly analysis continues to recommend a STRONG BUY with Weekly analysis a BUY signal.

Technical indicators - Monthly Projections

RSI(14) | Buy |

STOCH(9,6) | Buy |

STOCHRSI(14) | Overbought |

MACD(12,26) | Buy |

ADX(14) | Buy |

Williams %R | Buy |

CCI(14) | Buy |

ATR(14) | Less Volatility |

Highs/Lows(14) | Buy |

Ultimate Oscillator | Buy |

ROC | Buy |

Bull/Bear Power(13) | Buy |

Summary for Monthly forecast: Strong Buy

*Not financial advice, please do your own prior to any investment decisions you make.