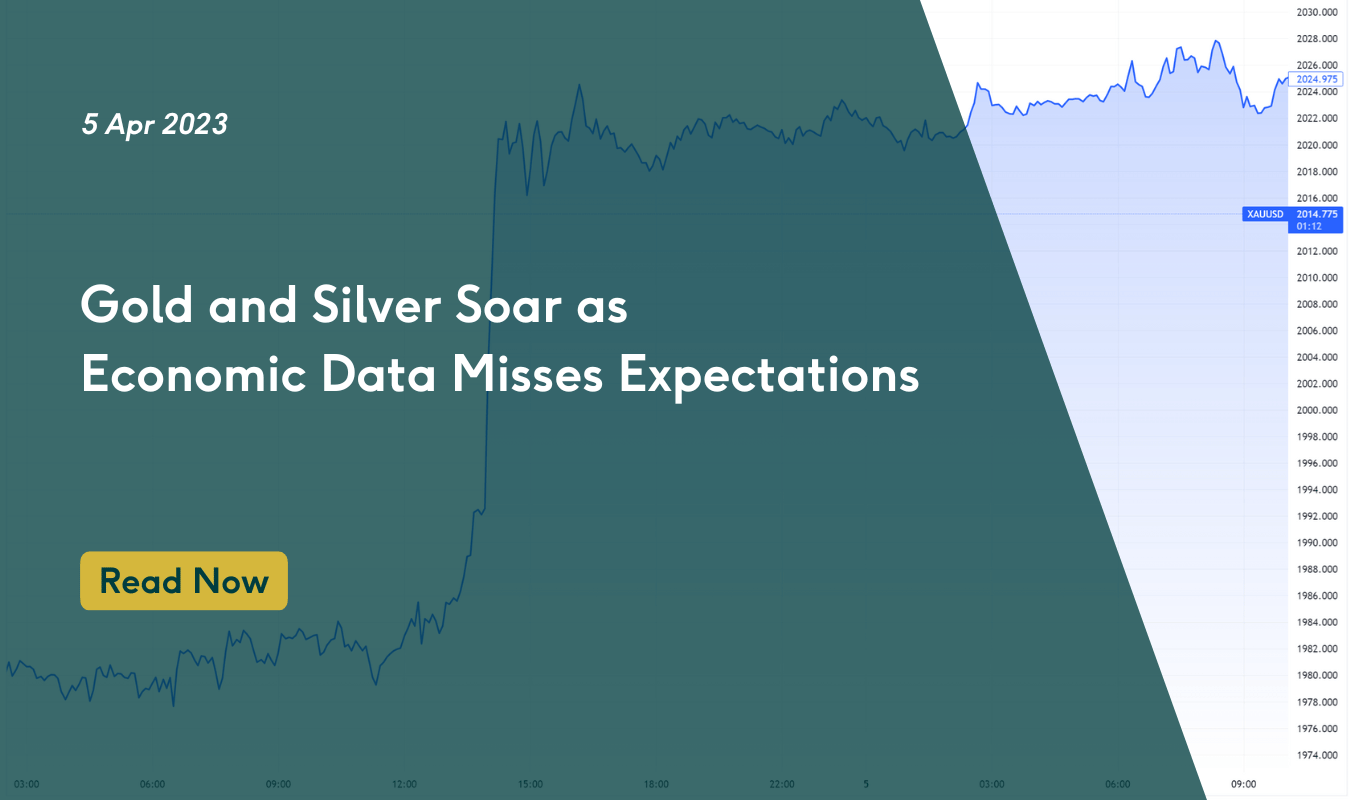

Gold and Silver Soar as Economic Data Misses Expectations

5 April, 2023

As a 10am, AEST

Gold Spot Price $AU2994

Silver Spot Price $AU37.14

Platinum Spot Price $AU1524

Last night Gold and Silver punched through their resting points, with Gold up 1.8% and Silver up 4.2% in the last 24 hours.

Silver was the best performer gaining $1.13 per ounce in price during the US trading session (while Australia slept).

In the US, ISM manufacturing and construction spending came in lower than expected, and Job openings also missed their target coming in 600,000 less than expected for the month of February. This Friday we’re also expecting a massive increase in consumer credit in the US, lifting from 14.8B to 20B. We’ll have more info on this during our Friday forecast.

Yesterday, Australia’s RBA chose to keep the cash rate target at 3.6%. While this might provide some welcome relief to mortgage holders, the grim reality has firmly set in for many Australians that simply don’t have the disposable cash they had at the same time last year. With the average mortgage in Australia at $586,000, average repayments on a variable interest home loan have rocketed to around $3,300 per month. That doesn’t leave much room to move with the cost of living pressures continuing to increase.

For those holding Gold and Silver, congratulations - you’ve picked a great moment to enjoy the upwards price movement. If you’re looking to take profit, be sure to keep Jaggards in mind when it’s time to sell. If you’re holding for the long term, you can also consider Jaggards to top up your holdings a little more.

We’ll catch you Friday for our weekly forecast.

*Not financial advice, please do your own research prior to any investment decisions you make.

30 days of Gold pricing (USD)

30 days of Silver pricing (USD)

Market Sentiment

30 Day Google trend positions for ‘Gold Price’. Stable and strong at 75/100

Twitter Sentiment 7 days

Tweets around Gold Price increased from 22,400 to 26,070 over the past week.