Gold consolidates and jumps higher

Gold continues its gains this week, topping out 7 continuous days of growth. Starting at $US2034 and currently sitting at $US2160 Gold is showing no signs of slowing down.

This week the FED’s beige book (Federal Reserve System publication about current economic conditions across the 12 Federal Reserve Districts) mentions that the economy grew in the last quarter while inflation and the labour market cooled. While welcome relief that inflation continues to cool, with continued robust economic growth the chances of an interest rate reduction within the next 3-6 months are pretty slim.

As we mentioned earlier, it is almost Silver’s time to shine as well. With huge potential for future price growth, over the past few days, we started to see signs of movement, currently trading around $US24.35 per ounce. With Gold’s daily RSI punching around 82 and Silver’s daily RSI sitting at 66 we could well see a reversal towards Silver in the coming week.

Next Wednesday we’ll discuss the US CPI results and how they will affect FED decisions in the short term.

Enjoy today’s charts and forecast.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

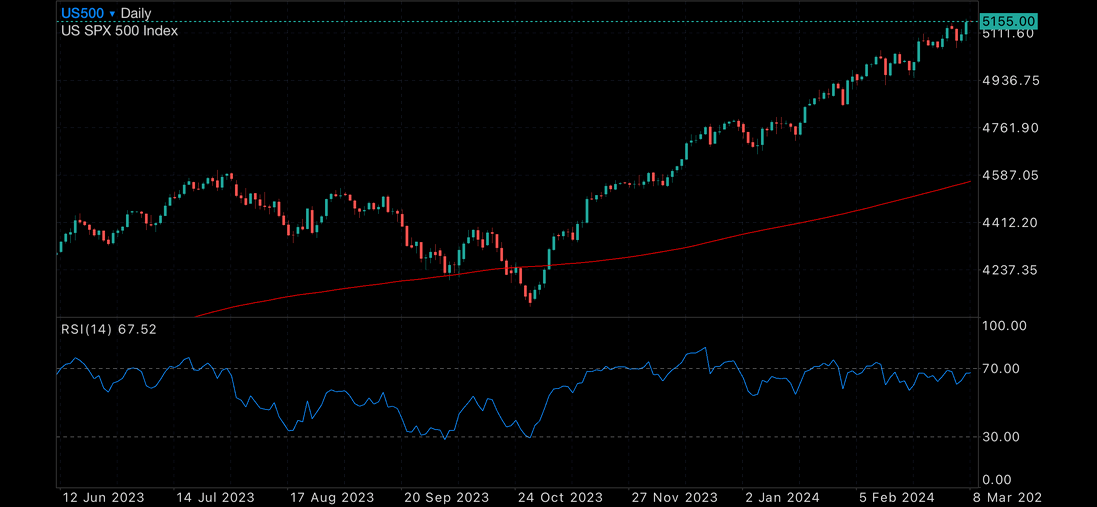

US500, with 200MDA

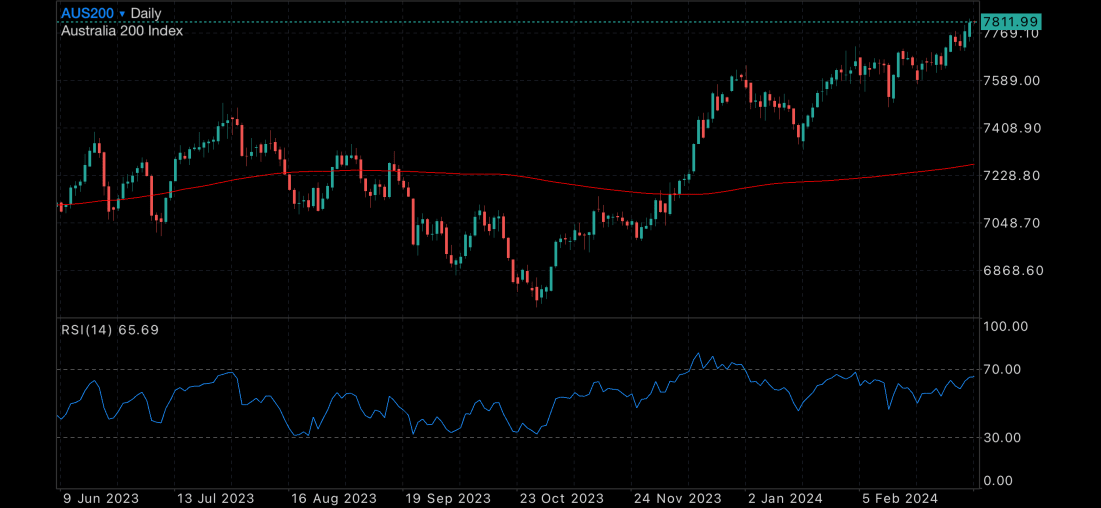

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures monthly analysis continues to recommend a STRONG BUY with Weekly analysis a STRONG BUY signal.

Technical indicators - Monthly Projections

| RSI(14) | Buy |

| STOCH(9,6) | Buy |

| STOCHRSI(14) | Overbought |

| MACD(12,26) | Buy |

| ADX(14) | Buy |

| Williams %R | Overbought |

| CCI(14) | Buy |

| ATR(14) | Less Volatility |

| Highs/Lows(14) | Neutral |

| Ultimate Oscillator | Buy |

| ROC | Buy |

| Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

*Not financial advice, please do your own research prior to any investment decisions you make