Gold soars on tariff nightmares

Spot pricing for Gold $AU4609

Spot pricing for Silver $AU50.72

Spot pricing for Platinum $AU1582

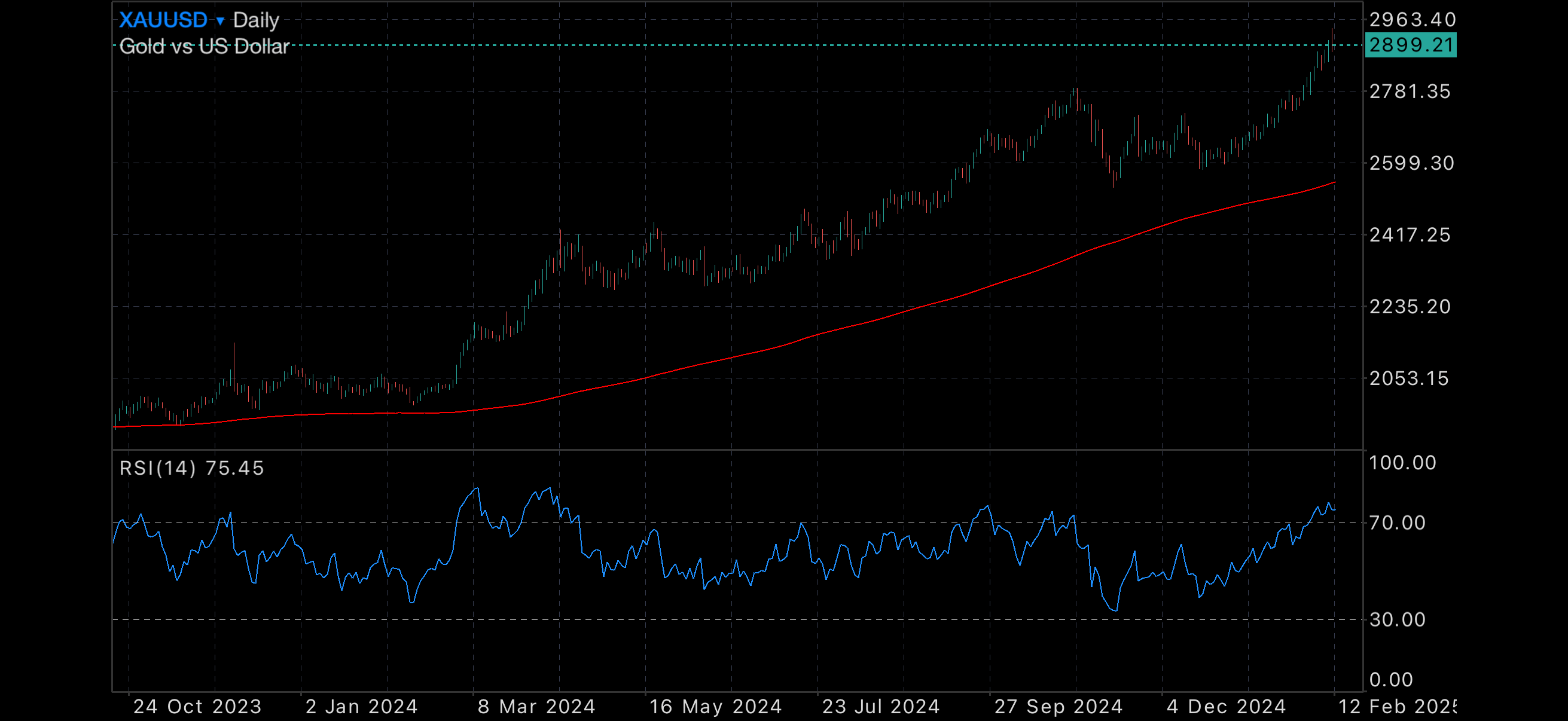

Gold has zoomed upwards this week, resultant of ongoing tariff threats from US President Trump.

At each and every tariff threat, currencies are moving wildly which in turn is making investors very uneasy. As more volatility enters the market we’re bound to see risk adverse investors simply moving into precious metals during this period.

And these risk adverse investors may well be right. With the FED reconsidering interest rate cuts as the data on inflation is beginning to look poor, cost of living in first world countries is once again the hottest news on the table. If Trumps tariff war is designed to bring manufacturing back home to the US, in the short term this is sure to drastically increase pricing for imported products and all products scrambling to be produced locally. While we are not in hyperinflation territory, the ongoing monthly price increases across imported goods puts even more pressure on Families who are yet to recover from the last 3-4 years of rate rises and pricing increases across the board.

If you’re holding gold, you ultimately hedge against this inflationary turmoil.

Enjoy today’s charts.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA