Gold Prices Soar Ahead of Fed Policy Meeting, Silver Volatility Continues

Welcome to Jaggards Wednesday Precious Metals Market Insights

1 February 2023

As at 9 am, AEST

Gold Spot Price $AU 2,737

Silver Spot Price $AU 33.66

Platinum Spot Price $AU 1,454

Market Sentiment

Google Search Trends

Gold

Gold Price as a search trend continues to reach peak popularity worldwide during the month of January.

Silver

Silver Price as a search trend shows continued volatility worldwide during the month of January.

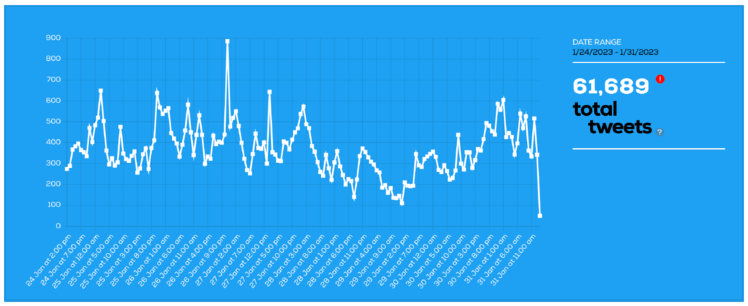

Twitter sentiment

Gold was tweeted 61,689 times in the last month (1 Jan - 31 Jan).

Market News Highlights

Gold investors are on high alert ahead of the U.S. Federal Reserve's policy meeting this week (Australia - Thursday), as expectations for a slowdown in rate hikes sparked an increase in gold prices. Inflation could be key; experts suggest if the Fed pauses while inflation remains steady, gold could be ready to explode. With rates headed towards 4%-4.75%, bullion holders can invest with confidence knowing that their opportunity cost is lower than ever before-taking advantage of its position as one of finance’s most reliable assets during times of higher than normal inflation.

Charts

Charts are shown in USD and show 30 days of activity. Gold prices over the past month have exceeded expectations and provided strong returns for investors, seeing $100 USD of growth during these past 4 weeks.

Gold has seen an impressive surge lately, with prices reaching a new high of $AU 2795, a nine-month high since the previous gold peak in March 2022. Analysts believe the rally is far from over, expecting prices to continue to rise in 2023. Contributing to the positive outlook for gold is economic uncertainty due to market turbulence, increasing recession fears, and central banks buying up gold. If these factors continue to be in play, gold could hit new record highs in 2023.

Silver prices experienced a more volatile month, bouncing between $US23.2 and $US24.2 during the period, finally resting at $US23.6 at present.

Take Control of Your Financial Future: Invest in Precious Metals Today

Next Market Insight - 3 February 2023

With the Fed Policy Meeting outcomes just around the corner, now is the time to take advantage of the market and invest in your financial future. Join us for our next Market Insight where we'll explore the market response to the Fed meeting and see how it affects precious metal prices.

Don't miss out on this opportunity to secure your financial future. Invest in precious metals today!