Rate cuts off the table and Israel threatens all out war

The FED and the RBA are both holding back on promising rate cuts through to the end of 2024 (at least).

With Australia’s RBA more likely to bring the first rate cut in February next year, many Australians are now holding on for dear life.

“Although rate cuts are now expected in 2025, most still predict the next move will be down,” Mr Kusher (ANZ) said. ANZ last week became the first big four bank to scrap forecasts of a rate cut this year, now expecting the RBA will remain on hold until February 2025

Flipside, Switzerland have continued their monetary easing policy. The Swiss National Bank cut its main policy rate by 25 bps to 1.25% on June 20, its second rate cut in 2024.

Reflecting on the previous monetary easing cycle in recent history and its outcomes - the next stage we’d anticipate seeing is currencies to start bouncing around everywhere. Generally speaking, as a country cuts its rates, its currency weakens against the USD. While for some countries this can help stimulate exports as their goods become cheaper on the international market, but for others it can spell devastation if they rely on imports to survive. If Australia’s currency weakens too aggressively we could well have even more cost of living pressure, especially as we import much (if not all) finished products. Our government may try and sell the sizzle of better iron and coal exports, but it is consumers that will really pay the price for whitewoods, cars, technology and food.

Gold and Silver have jumped on the back of more geopolitical conflict news. Israel has threatened ‘all out war’ with Lebanon and Russia has signed an alliance with North Korea. Both pieces of news sent the precious metals flying upwards within the last 24 hours.

Enjoy today’s forecasts.

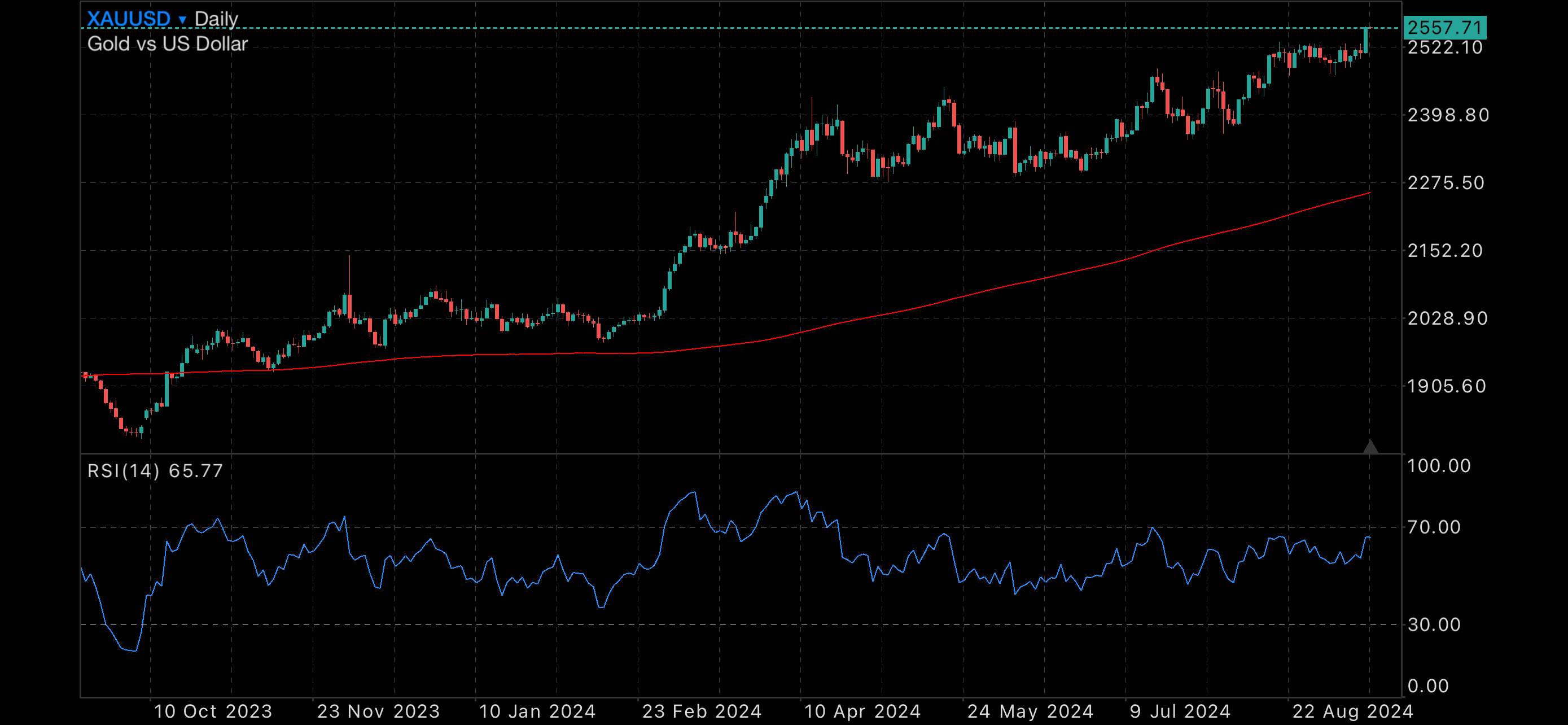

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

US500, with 200MDA

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures monthly analysis continues to recommend a STRONG BUY with Weekly analysis a BUY signal.

Technical indicators - Monthly Projections

RSI(14) | Buy |

STOCH(9,6) | Buy |

STOCHRSI(14) | Buy |

MACD(12,26) | Buy |

ADX(14) | Buy |

Williams %R | Overbought |

CCI(14) | Buy |

ATR(14) | Less Volatility |

Highs/Lows(14) | Buy |

Ultimate Oscillator | Neutral |

ROC | Buy |

Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

*Not financial advice, please do your own reserach prior to any investment decisions you make.