Sharemarkets jump, indicators seemingly healthy

Gold Spot Price $AU3503

Silver Spot Price $AU44.49

Platinum Spot Price $AU1483

The SP500 has stretched out to a new all time high of 5487 giving investors optimism that this current rally is pushing onwards with no fear of any correction. With much of the market being propped up by AI darlings, current market sentiment is an interesting blend of extreme greed and fear across multiple metrics. With market momentum hitting extreme greed, price strength and breadth are knocking on extreme fear. Safe Haven indicators suggest fear, as most investors see the market as overvalued at present.

Gold markets look set to dance around current pricing for the next 6 months according to Wells Fargo (over 1.9T in assets). In an interview with Kitco News, John LaForge says, “If you're an Indian consumer, all of a sudden, year-to-date, your gold has become 30% more expensive,” he said. “Generally, what we find with consumers is they don't stop buying. They just buy a little bit less. That’s why I think gold might churn for a little bit over the next six months.”

Silver has had a rough couple weeks, pulling back to previous consolidation points around $US29. We’d hope to see pricing for silver strengthen from here, or look to further downside to around $US27.

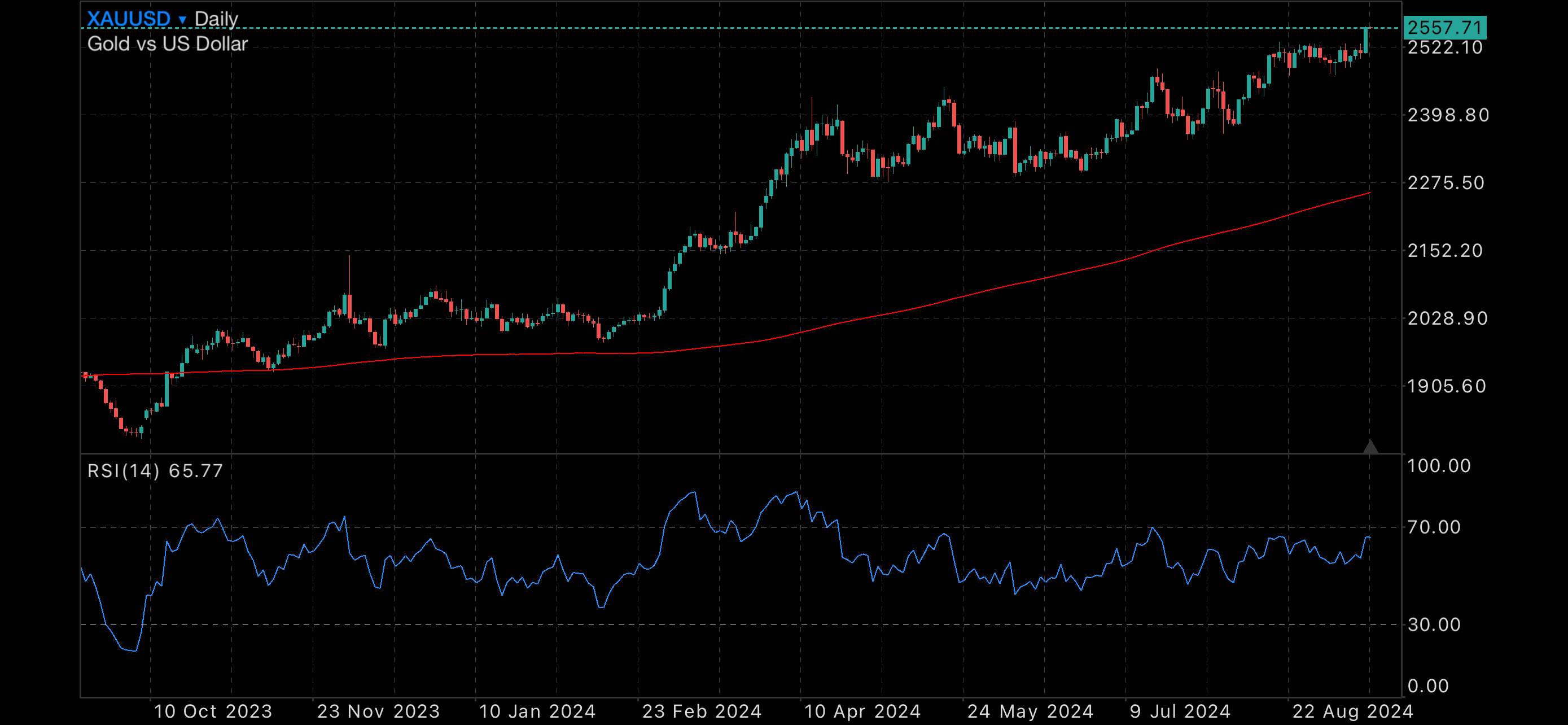

Gold looks to be following a holding pattern between $US2280 and $$2380 - and if continues to hold this range it could receive upwards pressure from its moving average within the next month or two.

Enjoy today’s charts.

Gold daily, with 200MDA

Silver daily, with 200MDA

US500, with 200MDA

ASX200, with 200MDA