US Sharemarket Peering over the Cliff

Equity markets around the world almost found steady footing following the Israel/Iran tit-for-tat attacks supposedly reaching a point of completion.

However, talks have now started around Israel’s response to Iran’s recent attack (Which involved launching several hundred ballistic missiles, cruise missiles and attack drones at the Country). Just mention that Israel is now planning its response has kept US equity markets in the red. The concept of yet another prolonged conflict or even War in the Middle East has sent nervous investors straight to Cash or Gold in the past week and will likely send more to the same conclusion in the coming weeks.

In other news similar to our Australian woes for housing capacity; The US may well be on the same path. Only 1.32M housing builds were started - 230,000 less than in previous months' data. Whether too much regulatory tape, cost of materials increase or labour shortages, the list of reasons for delays to building continues to grow.

Gold and Silver look to be consolidating just below their respective psychological ceilings, with Gold currently sitting at $US2378 and Silver at $US28.25 per ounce.

As news continues to unfold from Israel, we can only see continued upside movement for Gold and Silver into the coming weeks.

Enjoy today’s charts and forecast.

Gold daily chart, with 200MDA

Silver daily chart, with 200MDA

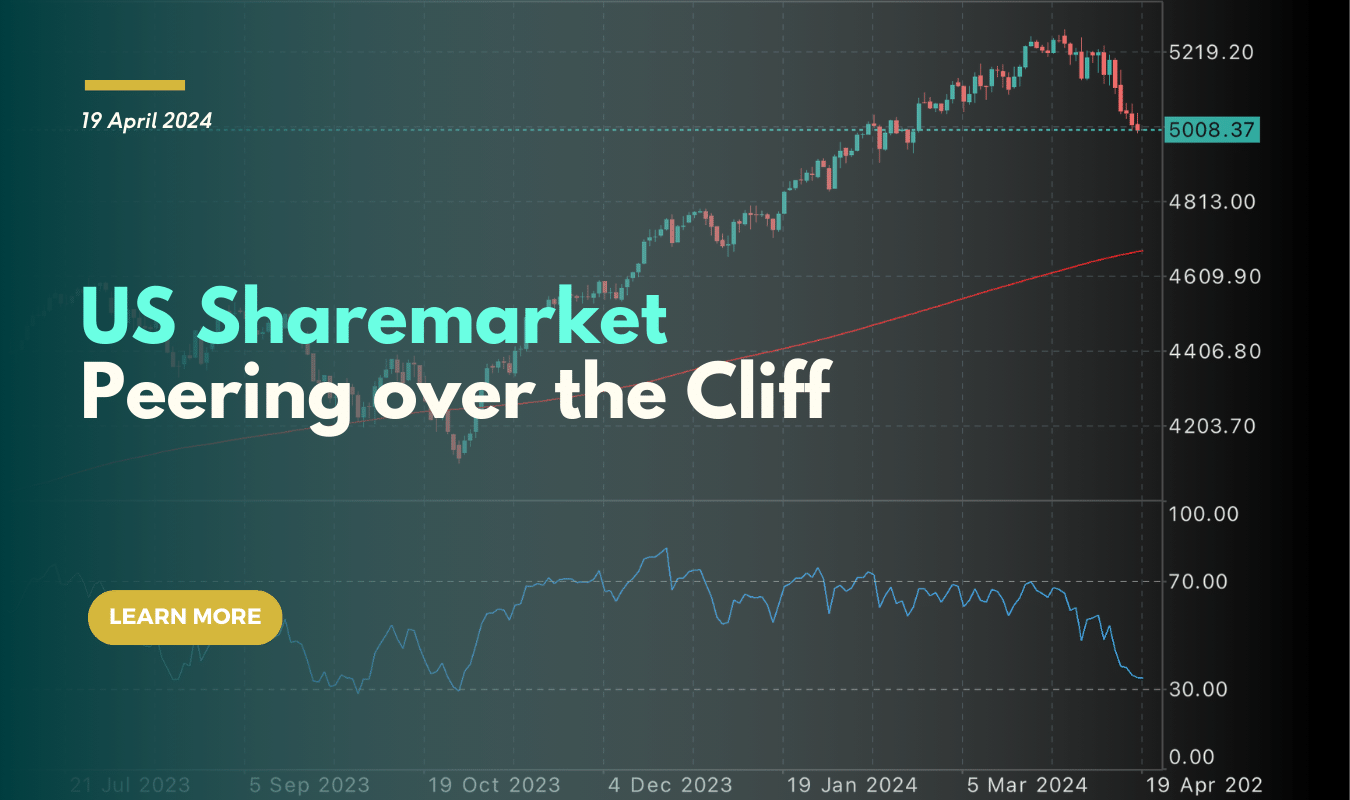

US500, with 200MDA

ASX200, with 200MDA

Gold Futures Technical Analysis

Gold Futures monthly analysis continues to recommend a STRONG BUY with Weekly analysis a STRONG BUY signal.

Technical indicators - Monthly Projections

RSI(14) | Buy |

STOCH(9,6) | Neutral |

STOCHRSI(14) | Overbought |

MACD(12,26) | Buy |

ADX(14) | Buy |

Williams %R | Overbought |

CCI(14) | Overbought |

ATR(14) | Less Volatility |

Highs/Lows(14) | Buy |

Ultimate Oscillator | Overbought |

ROC | Buy |

Bull/Bear Power(13) | Buy |

Summary for Monthly Forecast: Strong Buy

*Not financial advice, please do your own research prior to any investment decisions you make.