An Introduction to Bullion: What You Need to Know

Investing in bullion can be a great way to diversify your portfolio and hedge against inflation. But it’s important to understand the basics of bullion before investing. In this article, we’ll explore what bullion is, bullion as an investment, the history of bullion, the market price determination, and LBMA Standards.

What Is Bullion?

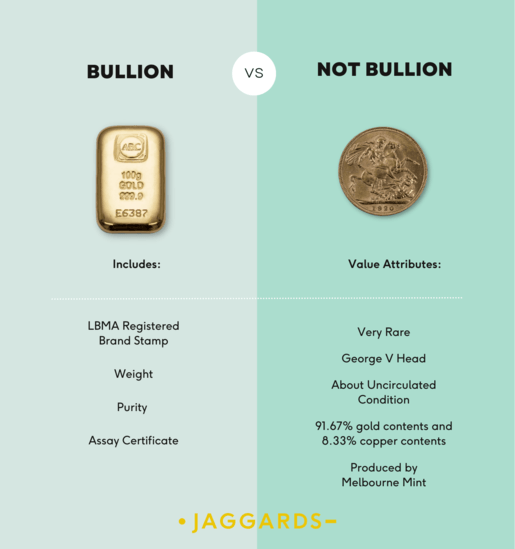

Bullion refers to precious metals, such as gold, silver, platinum, and palladium, that are traded in the form of bars or coins based on their weight and purity. Its value lies primarily in its metal content and its price is determined by the current market price of the metal.

Bullion bars are cast in standardized sizes and serve as a store of value or investment. Coins, on the other hand, are often minted by governments and have a face value indicated by a denomination, but their primary value is in their metal content.

Bullion's purity is expressed as a percentage of fineness and is indicated on the bar or coin, along with the weight and producer/mint's name. The weight of the bar or coin plays a significant role in determining its value, with larger bars or coins typically commanding a lower premium per ounce of metal. Bullion bars are usually sold in ounces, grams, or kilos, while coins are sold in ounces, fractional ounces, or grams.

What is NOT bullion?

It's important to note that not all precious metal products can be classified as bullion. Products such as jewellery, coins with numismatic value, collectible coins, and scrap silver or gold are not considered bullion because their value comes from factors other than their metal content, such as rarity, condition, age, or historical significance. For example, a gold coin from ancient Rome may have numismatic value due to its historical significance, but its value would not be based on the current market price of gold. Similarly, a gold ring with intricate designs would have value as jewellery, but not as bullion. To be considered bullion, a product must be valued primarily for its metal content and be traded based on weight and purity.

Bullion as an Investment

People invest in gold bullion and silver bullion for different reasons, but the primary reason people invest in gold bullion is due to its perceived value as a safe haven asset and its history as a store of wealth. Gold bullion is often seen as a hedge against inflation, currency fluctuations, and economic uncertainty. Gold has been used as a store of value for thousands of years, and it is widely recognised and accepted worldwide.

Silver bullion, on the other hand, is often seen as a more speculative investment due to its industrial uses. Silver is used in a wide range of industrial applications, such as electronics, medicine, and solar panels, and its demand is driven by its use in these industries. As a result, the price of silver bullion can be more volatile than gold bullion and is more susceptible to fluctuations in the economy.

The History of Bullion

Bullion has been a valuable commodity for thousands of years, with evidence of the use of gold as a form of currency dating back to ancient civilizations such as the Egyptians and the Romans. In ancient times, gold and silver were used as a medium of exchange and a store of wealth. As trade and commerce evolved, the value of bullion increased, and it became a widely recognized form of currency. In the Middle Ages, gold coins were widely used for trade and as a store of wealth, and the concept of a standard weight and purity for gold coins was established.

The modern bullion market has its roots in the gold standard, which was widely adopted by developed countries in the 19th and early 20th centuries. Under the gold standard, a country's currency was pegged to the value of gold, and gold coins were widely used as a medium of exchange. The value of gold was set by international agreement and was used to determine the value of currencies. With the collapse of the gold standard in the 20th century, gold was no longer used as a currency, but it continued to be traded as a commodity.

Today, bullion is widely traded as a store of value and as an investment, and it continues to be a popular choice for investors seeking to protect their wealth from economic uncertainty and inflation.

Bullion Spot Price

Bullion's market price is determined by supply and demand and is influenced by various factors such as economic conditions, geopolitical events, and currency exchange rates. The spot price of bullion serves as a reference point for investors and traders when buying or selling precious metals in the form of bars or coins.

Fluctuations in the spot price can have an immediate impact on the price of bullion coins and bars, as they are valued primarily based on their metal content. A rise in the spot price of gold, for example, would result in an increase in the price of gold bullion. Conversely, a decrease in the spot price of silver would likely lead to a decrease in the price of silver bullion.

It's essential for bullion investors to be aware of the spot price and monitor market changes, as it helps inform their buying and selling decisions. Understanding the spot price of bullion is crucial for making informed investment decisions and maximizing returns.

London Bullion Market Association (LBMA) Standards

The London Bullion Market Association (LBMA) sets high standards for gold and silver bullion coins and bars by establishing good delivery standards for the global over-the-counter (OTC) bullion market. These standards aim to ensure the quality and authenticity of bullion products and promote the integrity of the bullion market.

Refiners must adhere to the following key components of the LBMA's good delivery standards for bullion:

- Purity: The minimum purity requirement is set, with gold bullion being at least .995 fine (99.5% pure) and silver bullion being at least .999 fine (99.9% pure).

- Weight: A minimum weight requirement is established, with gold bars having a minimum weight of 350 ounces (10.9 kilograms) and silver bars having a minimum weight of 1 kilogram.

- Brand: Refiners must be LBMA-approved, and the bullion must have a recognisable brand stamp.

- Documentation: Accompanying documentation, including a certificate of authenticity and an assay certificate, must be provided.

By adhering to the LBMA's good delivery standards, refiners are held to high standards in the production of bullion products. This helps to protect investors by ensuring that they are buying high-quality and authentic bullion products that can be easily bought and sold in the market.

Private Bullion Brands

The growth of bullion dealers and private businesses refining their own bullion has increased in recent times. These companies, while not necessarily approved by the London Bullion Market Association (LBMA), still maintain high standards of production and offer bullion products that are of high quality and purity. This gives investors the opportunity to purchase gold or silver bullion bars at competitive prices. However, it's important to be aware that these bars may not be as widely recognized or accepted in the market, making them difficult to sell. In some cases, these bars may only receive the melt value when sold, so caution should be exercised by investors considering these products.

Bullion is a great way to diversify your portfolio and hedge against inflation. It’s important to understand the basics of bullion before investing. Make sure to do your research and understand the different types of bullion, the history of bullion, the benefits of investing in bullion, bullion spot price, LBMA certified brands.

Shop with Confidence at Jaggards

If you’re looking to invest in bullion, Jaggards is you’re trusted partner. We offer a wide selection of gold and silver bullion coins and bars from LBMA-approved brands and our team of experts can help you make the right investment decisions.

Invest in bullion with Jaggards today!